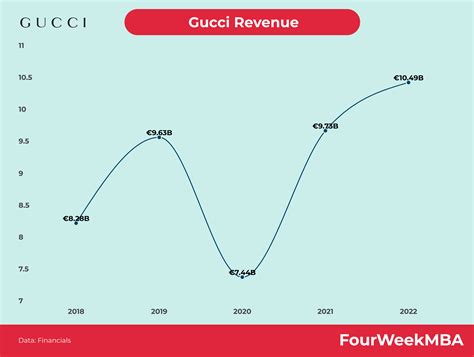

financial analysis gucci turnaround | Gucci sales and revenue financial analysis gucci turnaround The largest fashion brand in the Kering luxury empire—which includes Yves Saint Laurent a. Pēdējie Eurojackpot rezultāti tiek publicēti šeit uzreiz pēc izlozes. Jūs varat skatīt pēdējos laimējušos skaitļus, tostarp sīkāku informāciju par laimētājiem un balvām. Pēdējais rezultāts. Otrdiena, 2024 gada 7. maijs. 4× Uzkrājums. 3. 11. 32. 33. 35. 11. Jackpot €35 125 655. Šajā izlozē bija vairāk nekā 539 000 laimētāju.

0 · Gucci turnover

1 · Gucci sales and revenue

2 · Gucci sales 2021

3 · Gucci revenue 2021

4 · Gucci news

5 · Gucci company net worth

6 · Gucci business

7 · Gucci and Kering news

159 were here. BMW Oriģinālas rezerves daļas un Aksesuāri ar piegādi! Plaša izvēle. Var pasūtīt visu no BMW katologa. BMW Retrofit workshop.

Gucci was off 20%, from .6 billion (€5.1 billion) last year to .4 billion (€4.1 billion) and recurring operating income took a 44% dive to .1 billion (€1 billion). In all regions, .

The largest fashion brand in the Kering luxury empire—which includes Yves Saint Laurent a.

Gucci turnover

Gucci sales and revenue

Financial Strength. Kering substantially decreased its net debt position in the prepandemic years thanks to its strong cash generation. In 2023, net debt/EBITDA stood at . The largest fashion brand in the Kering luxury empire—which includes Yves Saint Laurent and Bottega Veneta—Gucci delivered revenues of €9.7 billion (.02 billion), up . Kering, the owner of high-end brands such as Gucci and Yves Saint Laurent, is scheduled to report results for the third quarter on Wednesday after markets close in France. . Can Gucci’s Turnaround Plan Still Work? This week, Kering flagged sales were down 20 percent at its flagship brand, knocking confidence in the group’s turnaround strategy. .

The long-awaited comeback at Italian fashion house Gucci helped the group beat analysts’ expectations for annual sales and operating profit and propose a record dividend of . Kering vaunted Gucci’s transition to a directly-operated business—cutting out multi-brand boutiques and limiting e-tailer exposure—as a key financial headwind, which may . PARIS, France — French luxury-goods maker Kering SA reported first-half earnings that beat analysts' estimates on rising demand for Gucci loafers and Yves Saint Laurent .Gucci’s recurring operating income totaled €3,715 million in 2021, 42% higher than in 2020. Recurring operating margin was particularly solid at 38.2% in 2021, while the House kept up .

Gucci owner Kering said first-half revenue and earnings fell as its flagship brand pushed ahead with a turnaround at a time the luxury industry is contending with a spending . Gucci was off 20%, from .6 billion (€5.1 billion) last year to .4 billion (€4.1 billion) and recurring operating income took a 44% dive to .1 billion (€1 billion). In all regions, Gucci. Financial Strength. Kering substantially decreased its net debt position in the prepandemic years thanks to its strong cash generation. In 2023, net debt/EBITDA stood at 1.4 times. We expect it.

The largest fashion brand in the Kering luxury empire—which includes Yves Saint Laurent and Bottega Veneta—Gucci delivered revenues of €9.7 billion (.02 billion), up 31.2% from 2020, exceeding. Kering, the owner of high-end brands such as Gucci and Yves Saint Laurent, is scheduled to report results for the third quarter on Wednesday after markets close in France. Here is what you need. Can Gucci’s Turnaround Plan Still Work? This week, Kering flagged sales were down 20 percent at its flagship brand, knocking confidence in the group’s turnaround strategy. ‘A more drastic solution is required,’ one analyst wrote.

The long-awaited comeback at Italian fashion house Gucci helped the group beat analysts’ expectations for annual sales and operating profit and propose a record dividend of €12 a share for. Kering vaunted Gucci’s transition to a directly-operated business—cutting out multi-brand boutiques and limiting e-tailer exposure—as a key financial headwind, which may have exacerbated that gap. Gucci’s wholesale revenues are down 39 percent since 2019. PARIS, France — French luxury-goods maker Kering SA reported first-half earnings that beat analysts' estimates on rising demand for Gucci loafers and Yves Saint Laurent fashions, helping it shrug off lower tourism in Europe.Gucci’s recurring operating income totaled €3,715 million in 2021, 42% higher than in 2020. Recurring operating margin was particularly solid at 38.2% in 2021, while the House kept up the pace of its investments and clienteling initiatives.

Gucci sales 2021

Gucci owner Kering said first-half revenue and earnings fell as its flagship brand pushed ahead with a turnaround at a time the luxury industry is contending with a spending downturn in China. Gucci was off 20%, from .6 billion (€5.1 billion) last year to .4 billion (€4.1 billion) and recurring operating income took a 44% dive to .1 billion (€1 billion). In all regions, Gucci. Financial Strength. Kering substantially decreased its net debt position in the prepandemic years thanks to its strong cash generation. In 2023, net debt/EBITDA stood at 1.4 times. We expect it. The largest fashion brand in the Kering luxury empire—which includes Yves Saint Laurent and Bottega Veneta—Gucci delivered revenues of €9.7 billion (.02 billion), up 31.2% from 2020, exceeding.

Kering, the owner of high-end brands such as Gucci and Yves Saint Laurent, is scheduled to report results for the third quarter on Wednesday after markets close in France. Here is what you need. Can Gucci’s Turnaround Plan Still Work? This week, Kering flagged sales were down 20 percent at its flagship brand, knocking confidence in the group’s turnaround strategy. ‘A more drastic solution is required,’ one analyst wrote.

The long-awaited comeback at Italian fashion house Gucci helped the group beat analysts’ expectations for annual sales and operating profit and propose a record dividend of €12 a share for.

Kering vaunted Gucci’s transition to a directly-operated business—cutting out multi-brand boutiques and limiting e-tailer exposure—as a key financial headwind, which may have exacerbated that gap. Gucci’s wholesale revenues are down 39 percent since 2019. PARIS, France — French luxury-goods maker Kering SA reported first-half earnings that beat analysts' estimates on rising demand for Gucci loafers and Yves Saint Laurent fashions, helping it shrug off lower tourism in Europe.Gucci’s recurring operating income totaled €3,715 million in 2021, 42% higher than in 2020. Recurring operating margin was particularly solid at 38.2% in 2021, while the House kept up the pace of its investments and clienteling initiatives.

Gucci revenue 2021

Gucci news

Gucci company net worth

Gucci business

Steps. And We Shall Call It Pyros is a level 70 quasi-quest. There are no steps to this quest: Talking to the questgiver both accepts and completes the quest. It will immediately unlock The Forbidden Land, Eureka Pyros . Journal. There are no journal entries for this quest. Dialogue. Rodney: A fine day to you, adventurer!The Forbidden Land, Eureka Quests. See also: Feature Quests and The Forbidden Land, Eureka While there are four primary quests, most story content in Eureka is derived from quests within each instanced zone.

financial analysis gucci turnaround|Gucci sales and revenue